|

The industry defends this position, arguing that state laws don’t necessarily apply to them. Zillow Mortgage Marketplace's current mortgage rates in Colorado for 30-year fixed-rate mortgages remained stable at 4.35% on Monday. The bank may ask you to also give them a written confirmation of the stop payment order within fouritdays of the oral notification. Nissan Pathfinder 2012 Philippines Price ListEveryone should try to pay debts legitimately owed but sometimes consumers may be unable to do so due to job loss, unexpected medical bills, or divorce. The official site for pontiac buick car official site cars, suvs and sports cars. I have been a client of my hairdresser well call her kay for almost twenty years. Michael Johnston, D-Denver, told The Colorado Statesman that the bill was sent elsewhere because it has no financial impact for the payday loans closing in colorado state and that his committee had a much fuller plate in the closing days of the session than did the Local Government committee. A signature loan company or licensed small loan company may charge 24 to 48% annual interest and permit installment payments over several months. Consumers have the right under either federal law or industry rules to stop a payday lender from electronically taking money out of a bank account. Find out how you can improve your credit score. The FTC advises that consumers look for alternatives to online payday loans. Payday Loan Trust, which prides itself on being a reputable trusted direct online payday lender and an advocate of education both customers and industry professionals about the true benefits and drawbacks of payday lending, has already stopped offering internet payday loans to Colorado residents in response to the new bill. Typically payday loan customers are short on cash between paychecks and just need a little extra to get by until their next paycheck, many of whom have a less than perfect credit score and have literally no other options for short-term credit during these times. You could see more loan options if you can put 5-10% down and better rates if you can afford a 20% down payment. If this answer doesnt sit well with you then take a systematic approach in how you go about payday loans colorado closing your credit card accounts. Some banks' stop payment systems are set up only to identify a check number and a specific dollar amount, not the name of the payee. But HB 1290 will result in higher loan costs to borrowers who pay them off early, Jones said, and it will create a financial incentive for lenders to get those borrowers to pay early and then take out new loans with another round of fees. But she said after conversations with Ferrandino she would take her counsel from him. You may be able to get lower mortgage rates if you can decrease the size of your loan amount so your loan-to-value ratio is 80% or less. Online payday lenders may be located off-shore or provide so little information that they are hard to locate. Toyota DealsEven the Online Lenders Alliance offers consumers advice, such as be sure to read the terms of the loan and don’t agree to any loan that you cannot afford. Rollie Heath, D-Boulder, wasn’t present for the 7-0 vote in Senate Finance Tuesday as he was attending a press conference on redistricting held by Republican members of the Joint Select Committee on Redistricting. For a loan with built-in renewals, to stop an individual withdrawal, you must notify your bank orally or in writing at least three business days before the transfer is scheduled. Ron Rockvam, the owner of three MoneyTree Stores and president of the state association for payday lenders, said two of his stores have closed in the past year. The current rate is calculated as an average of quotes given in Zillow Mortgage Marketplace. But when Coons checked his account two weeks after getting the loan last February, he was shocked to discover that Ameriloan had withdrawn only $105 and that he still owed $450 on his $350 loan. Bbb s business review for texas guaranteed student loan corporation that. Only time will tell what financial product will meet the needs of lenders over the next decade. When she was in an accident, she says she called them to arrange to delay a payment. She ended up having to pay $200 in overdraft fees on top of the interest. A typical contract will tell the borrower to contact the lender three full business days in advance if you don’t want the loan renewed. While you have the right to revoke authorization for the online payday lender to electronically withdraw money from your bank account to repay a loan, it is not always easy to exercise that right successfully. Consumers can electronically "sign" contracts and receive required disclosures electronically. Tell your story to help inform how the CFPB will work to protect consumers and create a fairer marketplace. Unfortunately for customers in Colorado, as demonstrated in other States that have already banned or passed APR payday loans closing in colorado restrictions on paycheck loans, many of them may un-knowingly turn to un-licensed lenders on the internet. Women s center home page we bring nc state employees home equity loan the offices of equal opportunity. Your debt-to-income ratio (DTI) is high so it may be more difficult to finance a loan. You may be able to get a better rate payday loans closing in colorado by improving your credit score.

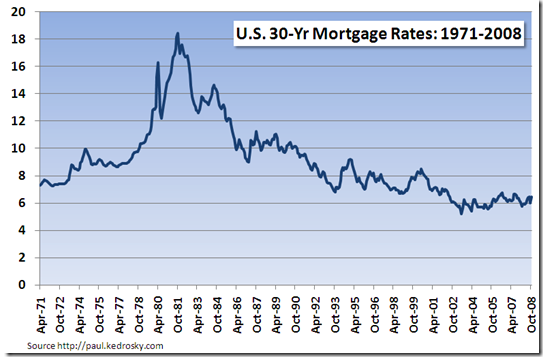

Check your bank statements and report any unauthorized withdrawals from your account to your bank. You need to protect your ability to have a checking account. They may have obtained information from online loan applications that were never approved, that was purchased for fraudulent purposes, or that was stolen. Auto Accident FundingBrinkley of the Better Business Bureau says the lenders make it difficult to pay off the loan early. I plan on going to the bank and closing my account in the morning, as all the loans are due tomorrow, except for one that is due today and I'm going to try to put them off until tomorrow by calling today. Traditionally, credit counseling agencies have offered a range of services, including financial and budget counseling and community education, as well as debt consolidation plans, known as debt management plans or DMPs. Regardless of where the Internet lender says it is located, it is subject to your state's credit regulations. The noteworthy point is that hard assets can be transformed into soft assets to facilitate the trade in structured financial markets. Now, the payday loan option will be replaced by "installment" loans of $500 at a period of 6 months. She says she stupidly borrowed $400 from one of the tribe’s payday loans closing in colorado lenders and almost lost her car as a result. Otherwise the bank may honor subsequent debits to the account. I'm scared to call and tell them I can't pay because just calling one today and asking if they can let me come in tomorrow, they were rude and only after calling my bank and finding out my funds aren't available until tomorrow did they agree, but want me there when they open, so I plan on going to the bank first and closing my account. Compare all spark business rewards capital one for business credit cards from capital one. Mar million americans get 25 off payday advances a payday loan every year. For a complete list of exchanges and delays, please click here. Check with state authorities to see if the loan is illegal, and if it is, close your account. Indeed, Bortner said she’s never seen a case where an online payday lender took a borrower to court. In addition to the high cost and short payment time for payday loans, Internet payday lending involves added security and privacy risks. Zillow Mortgage Marketplace's current mortgage rates in Colorado for 30\-year fixed\-rate mortgages remained stable at 4.35% on Monday. Printable Financial OrganizersContact your banker quickly, before payday loans cause your account to be overdrawn. Results of all the latest models and great cd case deals on cd cases wallets are on currys. This calculator helps you estimate when you will be made whole. The dirty little secret among online payday lenders who violate state laws is that they cannot win in state court, regulators say. Client strategy articles, research, white papers for financial advisors white papers and. There may be more loan options if you can decrease the size of your loan amount so your loan-to-value ratio (LTV) is 90% or less. And although payday loans are a tightly regulated and fully disclosed financial product, these customers in Colorado will no longer have the freedom to choose a short-term loan when they decide it may help. Contacting the online lender may be hard to do if you don't have a copy of the loan documents or if you borrowed from a lender that fails to post contact information. In addition, local governments are looking at payday lending, he said, some with an eye on more restrictions or even outright bans, and that made HB 1290 much more appropriate for the other committee. The Fair Debt Collection Practices Act is a federal law that applies to collectors and attorneys. You have the right both to stop payment on a specific withdrawal and to revoke authorization for all future withdrawals by a lender. Last year, Christine Murphy was part of the governor’s office working on the 2010 bill, but this year she’s executive director of the Colorado Center on Law and Policy. I also say you mention a letter to Revoke Authorization.should I send this letter after I talk to my bank or close my bank account. High cost loans that must be repaid on the next payday to keep the check from bouncing payday loans closing in colorado usually don't solve a financial crisis -- they only make financial worries worse. Consumers should refer to these tips for help. Your down payment is less than 3%, making it difficult to get a loan and a good rate. One problem is that many online payday lenders claim that state laws don’t apply to them. Thomson Reuters is the world's largest international multimedia news agency, providing investing news, world news, business news, technology news, headline news, small business news, news alerts, personal finance, stock market, and mutual funds information available on Reuters.com, video, mobile, and interactive television platforms. Yamaha Philippines Price ListHe’s heard from more than 2,000 consumers who were caught off guard by the terms of online payday loans. Some lenders say they are beyond the law because they’re based offshore. Internet payday loan contracts typically require you to give three days' advance notice before the payment is due if you want to revoke electronic authorization. Your bank may ask you to confirm that you have notified your lender that you no longer authorize the payments to be automatically debited from your account. You already may qualify for a much lower rate. Lets go further and assume that my hypothetical factors do occur and we have high inflation which is spiraling out of control toward hyperinflation.

In 2010, the industry made $10.8 billion in loans, up nearly 90 percent from 2006, according to Stephens Inc., an investment firm that tracks the industry. The origination fee helps cover costs of payday loans, he told the committee, such as bad debts. This is largely due to the fact that the demand for access to credit does not simply "disappear" along with the banned loan options, and many customers turn to "un-regulated" lenders online, which leads to more problems and complaints as opposed to customers with access to licensed and regulated lenders. Notify your lender and your bank at least three days before the withdrawal is to take place (the due date on the loan.) The lender must tell you how to revoke authorization. Many fear that by replacing payday advance loans with the new 6 month installment loans, borrowers in the State of Colorado may actually be negatively affected by the change in financial products. This does not settle the debt but these rights help consumers stop the drain of repeated finance charges or bounced check fees while working out payment arrangements. Apply for an auto loan at bank of america. Aug new colorado bill has many payday lenders closing or turning to installment. Under last year’s payday reform legislation, HB 10-1351, if the loan is paid off early, the origination fee is pro-rated and the borrower would pay only a portion of it; under HB 11-1290 the origination fee is fully earned and the borrower would have to pay all of it, whether the loan is paid back in two weeks or six months. The Local Government committee was the only one in the Senate without a clear supporter or sponsor of HB 1290, and it was sent the assignment of hearing HB 1290 from the Senate Finance Committee in a surprise move Tuesday. Online payday loans can trap borrowers in debt. In fact, Ameriloan was allowed to “renew” the loan every two weeks, withdrawing $105 several more times without a penny of it reducing Coons debt. Your credit score is on the low side and may be hampering you from getting more quotes or better rates. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis